No matter your economic activity or sector. If you are going to import or export goods within the European Union, you need an EORI number. This is the identification data that you will be asked by the customs authorities. That is why, in this article, we will talk about you everything you need to know about this registration number: how to get one and which is its validity, differences with the VIES number, and other information that will be very useful to you.

What is the EORI number?

The EORI is the number used by customs authorities and economic operators to control the entry and exit of goods within the European Union for companies and individuals operating through this territory.

In other words, if you want to operate internationally within the EU, selling or buying goods through the different Member States, you must apply for the EORI.

Thus, we are not talking about a license that allows you to export or import. It is simply a registration number that helps authorities keep track of your intra-community operations.

Who should apply for this number?

Any entity, natural person or company, that carries out import or export activities within the European Union through its customs must apply for it.

That is, from a self-employed individual to a corporation, they need it if they are going to receive or send products.

In the case of an individual, the situation is somewhat different. They are not obliged to request this number until they have carried out more than 5 intra-community operations.

However, the Spanish administration has registered 90% of the SMEs in Spain. This means that it is very likely that if you have a Limited Liability Company (S.L.) or an S.A., you already have an EORI number assigned to you that coincides with your tax number.

In that case, you would not need to apply for it.

To find out if this is your case, you can check the validity of your EORI number here.

What is its composition or structure?

Each EU state has a different format. However, the first part has a common structure (although adapted to each country).

Thus, in Spain this number is composed of two different parts:

- Firstly, we find the first part, a 2-digit ISO code that depends on and varies according to the country. In the case of Spain, it is ES.

- Then the Tax Identification Number (NIF)

In the case of a company not established in the European Union, and therefore without a tax number:

- First, the 2-digit ISO code (ES) plus the letter K

- The ISO code of the country where it is established

- Finally, the number assigned by the Tax Office

Are the EORI and VIES numbers the same?

No. Although both identifiers have the same composition, their use is completely different.

The VIES number allows you to start trading within the European Union. It is a kind of “registration” you need in order to carry out your economic activity (no matter what that is). It is created because it allows you to make the relevant VAT adjustments, as there are differences regarding tax rates of the Member States.

You can access a complete guide on how to register on the VIES and get an international VAT here.

On the other hand, the EORI number allows import and export controls by the customs authorities.

To sum up: in order to start carrying out intra-community transactions, the first thing you must do to apply for the VIES number (the EORI is not enough). And, if your activity requires imports and/or exports you will also need to ask for the EORI.

How do I apply for the EORI?

We are talking about an easy and simple application process. The EORI number is applied for in the country where the first import/export takes place.

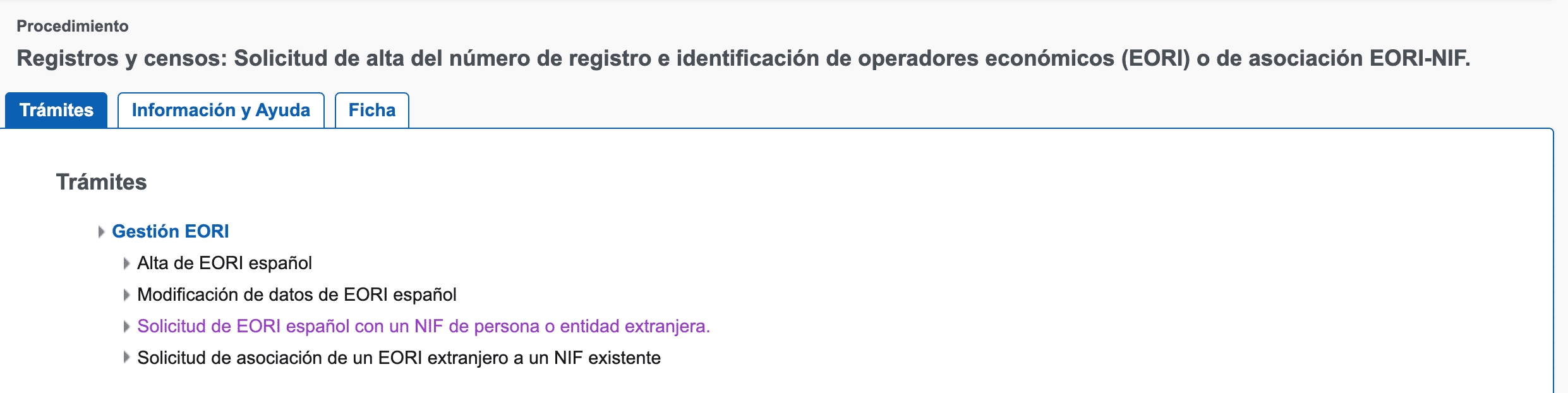

In the case of Spain, the competent authority responsible for reviewing applications and issuing this number is the Tax Office. Thus, you can apply for the EORI online (with a digital certificate), at the electronic platform from the AEAT.

You can start your application here.

Check the option “Alta de EORI español”, and enter your ID or digital certificate.

It is a unique number in the whole Union, so once you get it, it will be valid for any EU member state.

If your company operates in different EU countries, you must apply for an EORI for each corresponding country.

Finally, please note that it is not necessary to be VAT registered in order to apply for and obtain this identification.

EORI number for Spanish companies

When a company is set up and registered in Spain, it is automatically assigned a tax identification number or CIF.

As we have seen, in the case of commercial activities (requiring import/export of products), they are normally assigned an EORI number automatically at registration.

But there are certain differences in the case of a non-Spanish company.

EORI number for non-EU companies that want to operate in Spain

If you are a company from outside the European Union that wants to carry out import or export activities with Spain, it is necessary to apply for an EORI number.

This identification number will be requested at the customs office in Spain. Or, in its absence, in the country within the Union where commercial activities were carried out for the first time.

In the case of having a foreign EORI, an association with an existing NIF will be made.

How long does it take to get it?

Once you request the EORI, you’ll get it quickly. Although under normal conditions it is granted almost automatically, this process can take up to 24 and 48 hours.

This is why we recommend that you request it one or two weeks before the planned start of operations.

What documents do I have to provide in the application?

To apply for the EORI, you must provide the following documents:

- Identification document as a natural person: either DNI or NIE in the case of not being a Spanish national.

- Identification of the company from the business register

Please note that these documents must be properly translated into Spanish.

Start your application now

Do you still have doubts?

If so, or if you would like our team of business lawyers to apply for your EORI number, taking care of all communications with the relevant authorities, do not hesitate to contact us.

Book a consultation with one of our lawyers and solve all your doubts:

At Balcells Group we have been foreigners effortlessly moving to Spain for over 11 years. We help expats from all around the world with their immigration, business, tax and legal needs; ensuring a legally safe and enjoyable transition to the Spanish territory. Our multilingual team understands the importance of adapting to the cultural and legal specificities of our international clients. We offer a comprehensive service that combines the expertise of several generations of lawyers with the innovation needed to address today’s legal challenges, always striving to simplify processes and ensure reliable, effective results.