And if you are a company, keep on reading. We have also added a section with useful tips that will be totally useful when hiring new workers.

Without further ado, let’s get started.

What is a payroll in Spain?

A payroll is an official document that reflects the monetary amount that a worker receives as compensation for her services to the company in which she is hired.

In other words, the document in which you can find how much money you earn.

But unlike what we tend to think, payrolls do not only include the compensation or money we receive for the work we do. They also include the payment on account of the income tax and the deductions paid to Social Security.

In the vast majority of cases, these payrolls are issued on a monthly basis. This is the frequency with which a worker receives his salary.

However, there are specific situations in which it is also possible to receive the payroll quarterly, by the hour or on a weekly basis.

From the accounting point of view, it is a liability for the company, since it is represented as a monetary disbursement. And, in fact, it is usually one of the most important fixed costs for any firm.

Due to its relevance and complexity, there are extensive labor rules and regulations on paychecks.

Why are they so important?

Payrolls are a key element from both the point of view of the company and the worker.

First of all, they are of course one of the main fixed costs for any enterprise. In other words, they have a significant impact on net profit.

Any business requires personnel for the performance and operation of daily activities. And depending on what that costs, your product or service can be more or less profitable. That is why we must allocate the salary expenses to the production costs in order to understand exactly what’s the real cost for the company to offer their product or services to the market.

But, on the other hand, we have the worker’s point of view, which is no less important.

Without a doubt, the salary (reflected in the payroll), is one of the main motivators for the employee. Not only can it be a great incentive for them to do a better job, but it can also attract qualified talent to the company.

Hence the importance of understanding payroll and how it works. But perhaps this is something that we will not fully achieve until we see analyze each element composing it, which we will do in the next section.

Labour legislation on payrolls

At a general level, we find the Spanish Workers’ Statute Law. This is the main legal text regulating payroll and wage payments.

On the other hand, there are other equally relevant provisions, such as the General Law on Social Security, which regulates contributions and deductions to that institution.

Thus, it is also important to understand that the Ministry of Labor and Social Economy is the entity in charge of creating and managing the related legislation.

What is an electronic payroll?

An electronic payroll is nothing more than the pdf file that the worker receives at the end of the month with the salary to be received, and which replaces the traditional paper payroll.

As in most sectors and applications, the Internet has revolutionized everything. And the labor market with its paychecks was not going to be an exception.

That is why today the paper payroll version is increasingly in disuse.

What is its replacement? The electronic payroll, its digital version.

When we refer to the electronic payroll we are talking about the worker’s own payroll, with the only difference that it is available online.

This not only saves paper, but also speeds up the process. The employee can access his monthly salary much more quickly and easily, and the employer can issue it faster.

It is worth mentioning that it has the same legal validity as a paper payroll.

For example, Payslip is a Global Payroll Control Platform, leveraging AI-powered automation to harmonize payroll operations for multinational organizations.

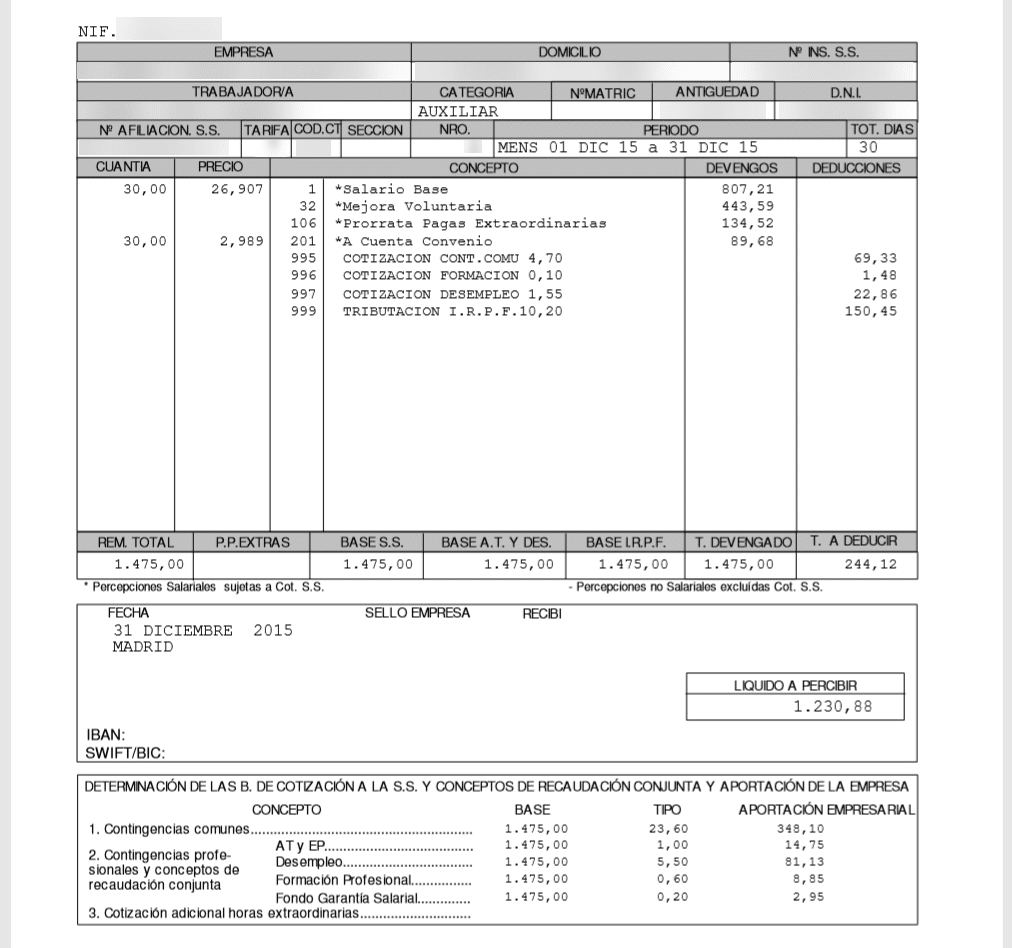

What are the elements of a payroll in Spain?

As we will see in the example, this document usually occupies a full side of paper. And because of the large number of elements it includes, it leaves almost no blank spaces.

So, which are the elements that make up a payroll?

- Company’s identification data, the first element of the header.

- Also in the header, we find the data relating to the worker who collects this payroll

- The date on which the payroll is issued; that is, the settlement period

- Accruals or compensation

- Deductions

- The liquid to be received, that is to say, the money that the worker gets

Let’s see each of these elements in greater detail.

Company details

The first section, located in the so-called heading, is where we can find the data concerning the company. More specifically:

- The name of the company that has hired the worker

- The address of that company (registered office)

- Its CIF (identification number for tax purposes)

- Social security contribution code

Worker’s data

The following section exhibits data regarding the worker who receives the payroll:

- Full name

- DNI or NIE number

- Seniority in the company

- Worker’s social security number

- The professional category or group

- The code referring to the type of existing contract

Remuneration

Remuneration refers to each of the concepts for which the worker is paid. Whether it is his or her usual working day, extra hours, etc.

In other words, all those concepts that make the monetary amount to be received as a salary increase.

The sum of the total remuneration forms what is known as the gross salary. This is not the one the worker receives at the end of the month, as there is still a key element to be applied.

This part of the payroll is, in turn, divided into two types of remuneration:

Wage compensation

These include the concepts for which the worker receives his salary; therefore, they contribute to social security.

We find in this case, and as a main element, the base salary. This is the one fixed by the collective agreements and varies according to the position the worker occupies in the firm. If there is no agreement, the base wage is the one agreed in the employment contract.

But, in addition, we find the salary supplements. That is, the differential between the basic salary and the extra bonus that the employee receives as a result of:

- Its experience

- Special knowledge that allows him to work more effectively

- Seniority in the firm

- Conditions of hardship, danger or toxicity in the workplace

- Extra hours

- The salary in kind; that is, the part of the salary received in the form of goods or services (company car, accommodation, etc.)

- Incentives, such as performance-related variables

Non-wage compensation

Here we find benefits, compensations, or substitutions that neither contribute to social security nor can be deducted from personal income tax.

These goods and/or services may represent a maximum of 30% of the total payroll.

For example, let’s suppose that a worker who travels daily with public transport has to pay in advance for this travel card. Obviously, this is an expense that the company returns to him at the end of the month. That amount or bonus to be received would be a non-wage remuneration.

Deductions

While we saw that with remuneration items the end salary increased, deductions are subtracted from it. That is, once we have the gross salary, we must subtract the total of deductions to obtain the net salary; the amount that the employee actually receives.

These deductions fall under two different types:

Income tax deductions

That is, the percentage of income tax to be paid that the company retains from the worker and advances in relation to the required annual payment.

The exact amount varies according to the worker, since it depends on the specific job; on his or her income level (income tax is a progressive tax), and on different demographic data such as marital status or age.

Social security contributions

What we find here is a part of the salary that is withheld and destined to create a “fund” for possible negative eventualities in the future in which such money could be needed. This is money that is used, for example, for unemployment benefits, maternity/paternity leave, medical leave, training, etc.

To calculate these deductions, the minimum and maximum limits are set each year by the government, and a percentage is used on those (the contribution rate).

Once these amounts have been deducted, we obtain the total earnings that the worker receives (net salary).

So, how do we calculate the minimum contribution to social security? To do this, we must separate the percentages according to the item in question:

- Common contingencies, equivalent to 4.7% of the salary, in which extra hours are not taken into account.

- Deductions for unemployment, which are equivalent to 1.55% in general contracts.

- Vocational training is 0.10%.

- Only force majeure overtime will be taken into account here, with a percentage of 4.7%.

Payroll example in 2020

Now that we have seen each and every element separately, let’s put them together using a real payroll example.

The Ministry of Labor provides us through its website a basic example, which you can find here.

But for more detail, we have attached an image in which you can see a real and complete payroll with all the elements and items that we have mentioned so far:

How is the salary calculated in Spain?

Now that we have seen all the elements that make up a payroll, answering this question is not a complicated task.

To calculate the salary you receive at the end of the month you simply need to subtract from your gross salary (all the remunerations, whether they are salary or not, that justify the payment of your work in the day to day with the company), the deductions to the social security and the payment of the personal income tax on account.

The result will be the net salary, the salary you receive at the end of the month.

In other words:

Salary = Gross salary (salary + non-wage compensation) – net salary (contributions to social security and IRPF deduction)

Bear in mind that this difference between gross and net salary can be up to 30%. That is why before accepting a job offer, we recommend that you analyze this point carefully and make the corresponding calculations.

Would you like to know how much you can expect to earn in Spain? Here you will find updated data about average and minimum salaries by profession and region.

How much is actually deducted from your salary?

As we have just mentioned, what is deducted from your salary is the advance payment of income tax and all the social security contributions.

In other words, they deduct the difference between your net salary and your gross salary.

But how much are we talking about exactly? Let’s look at it on the basis of both elements:

- In the case of social security contributions, they usually deduct between 4 and 10% of your salary. Nevertheless, the exact amount depends on the specific job.

- In the case of personal income tax, the answer is a little more complicated. Not only does it depend on your job, the amount to be deducted also depends on your age, income level, and family situation.

If you would like to know exactly how much will be deducted at the end of the month, let us help you. Our team of expert lawyers in accounting for companies and individuals will answer all your questions:

Tips when hiring workers in Spain

Now that we have seen exactly how a payroll works, there are a number of tips that stem from it. These are certainly very important tips that can save you on many occasions as a business owner.

Because the next step after setting up your business may be expanding your staff. And knowing how to do it properly is key.

Offer close-ended contracts

Firstly, from the employer’s point of view, it is usually much better to offer (at the time of contracting) a close-ended contract rather than a permanent one.

And the reasons are very simple. We live in a country where firing costs can be very high, which can make it very difficult for you to change your team accordingly in the future.

In addition, the ease with which an employee can initiate a lawsuit against dismissals is absolutely enormous; so you could also end up having to face legal costs.

So we recommend that you hire by offering a definite contract, and once you see how well the new worker performs, make him an indefinite offer.

In an offer, talk about gross salary and not net

In the elements section, we have seen how the first thing we get is the gross salary, but that this amount is not the total that the worker will receive.

We then have to apply deductions and other items that will make the gross become net, the actual amount to be received.

The important thing here is that this difference, depending on the job, can be great.

Therefore, we also recommend that when publishing your offer on online job portals or when negotiating with the future employee in the interview, you talk about gross salary, not net.

This will avoid problems and make things 100% transparent from the beginning.

Calculate your payroll online

Would you like to calculate your payroll online and discover how much you will actually earn at the end of the month?

Then let our team of expert labor lawyers help you.

Book a consultation with one of our lawyers and we’ll answer all your questions:

At Balcells Group we have been foreigners effortlessly moving to Spain for over 11 years. We help expats from all around the world with their immigration, business, tax and legal needs; ensuring a legally safe and enjoyable transition to the Spanish territory. Our multilingual team understands the importance of adapting to the cultural and legal specificities of our international clients. We offer a comprehensive service that combines the expertise of several generations of lawyers with the innovation needed to address today’s legal challenges, always striving to simplify processes and ensure reliable, effective results.