Taxes are everywhere. And moving to Spain won’t make them go away. In fact, they will become a crucial part of your new life in the country (no matter if you are a tax resident or not). But that is why we have created this article. After you finish reading this post, you will fully understand which are all the taxes in Spain for expats, how exactly the tax year works and which are all your legal obligations according to your particular case, and you will discover really useful tips that will help you save money (with allowances, deductions, and treatments with your home country).

Who must pay taxes in Spain?

Unfortunately, everyone.

Of course, Spanish nationals who live in the country must pay taxes. But foreigners too.

And even though there are important differences when it comes to the taxes to be paid depending on if you are a resident or not, both tax residents and non-residents must pay taxes in the Spanish territory.

Nevertheless, what is key here is understanding which are your specific tax obligations, and the different paths available to optimize your situation and avoid paying extra (which, in many cases, it is entirely possible to do). That is something you will learn in a second.

So as long as you live in Spain, conduct any kind of economic activity in the country, or simply own any kind of assets, you will have to pay taxes.

How the Spanish taxation system works + filling your tax return

Understanding taxes should not be that complicated. Let us demonstrate that through this section.

Unlike many countries (let’s say, the UK), the Spanish tax year goes from January to December, corresponding to a natural calendar year.

This is one of the things in which taxes in Spain are quite similar when compared to the ones in the US.

This just helps you understand the duration of the different tax obligations that will arise according to what you do in the country and your situation in general.

What does that mean?

That all the tax obligations that are created from the 1st of January to the 31st of December are packed together, and you will have to declare and pay them during the following year.

And that is done through your yearly tax return (which in Spanish is called “declaración de la renta”).

You will have to file your taxes from the 1st of May until the 30th of June of the following year. Not doing so in time means important economic penalties, so make sure to save the date and be prepared in advanced.

Nevertheless, if you earn less than €22,000 per year and that money just comes from just one payer (let’s say, one company), you don’t need to file this income tax return.

In order to realize that payment, you will need to be tax-identified against the corresponding institutions. This means that you will need your NIE number, which is the identification number you will need as a foreigner to formalized any kind of legal procedure.

All the tax-related issues in Spain, both for residents and non-residents, are regulated by the Spanish Tax Agency, the institution collecting yoru taxes.

If you want to stay in touch with the latest updates in this field, visiting their site is highly recommended, as they frequently upload the last updates to the tax regulation (plus you will find all the forms required for your submissions).

Are you a tax resident or a non-resident?

In order to exactly understand which concrete taxes you will pay in Spain and at which exact rate, the first thing you must do is to know wheter you are a tax resident or not.

This distinction just works for tax issues, and has nothing to do with the residence permit, and that allows you to legally live y in the country.

This means, perhaps you have a residence permit in Spain, but if you don’t meet the requirements, you may not be regarded as a tax resident for tax purposes.

Then, how do I know if I am a tax resident in Spain or not?

You will be considered a tax resident if you meet just one of the three following requirements:

- You live in Spain more than 183 days per calendar year, from January to December (note that the days don’t need to be consecutive in order to count)

- You have economic interests in the country, meaning that you realize your professional activity in Spain, whether you work for a company or you are self-employed. This is the typical case of someone who is hired by a Spanish company but spends the vast majority of the year traveling and meeting clients around the globe

- Your spouse and/or children live in Spain

Which are the taxes in Spain paid by expats?

Let’s recap.

Now you know that every year you must file Spanish taxes, and that you will have tax obligations no matter if you are a resident or not.

But, which are those tax obligations exactly? And how do they differ depending on your fiscal residency situation?

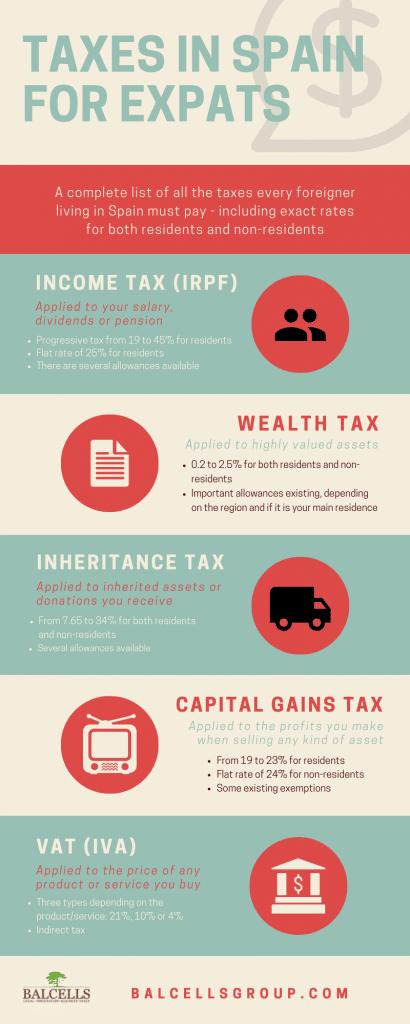

What’s next is a complete list of all the taxes you will have to pay as an expat, including their specific tax rates and allowances.

Infographic depicting all the taxes any expat/foreigner should pay in Spain!

Income tax (for residents)

First of all, perhaps the most important tax and the most commonly paid: the income tax; which is paid by tax residents in the country (those who are not residents must also pay income tax, but under the non-resident tax, which we will explore in the next section).

But what can be considered as income for the income tax payment?

- Salaries obtained as an employee and what you gain as a self-employed through your invoices

- Capital gains that come, for example, from dividends or interest rates

- Pension contributions and benefits

- Income that you obtain from renting a property

- Gains generated after selling any asset

- Etc

All these incomes will be liable to pay income tax, and you must include them through your income tax declaration.

If you are regarded as a Spanish tax resident, you must pay income tax for your income and gains worldwide.

And how much should you exactly pay?

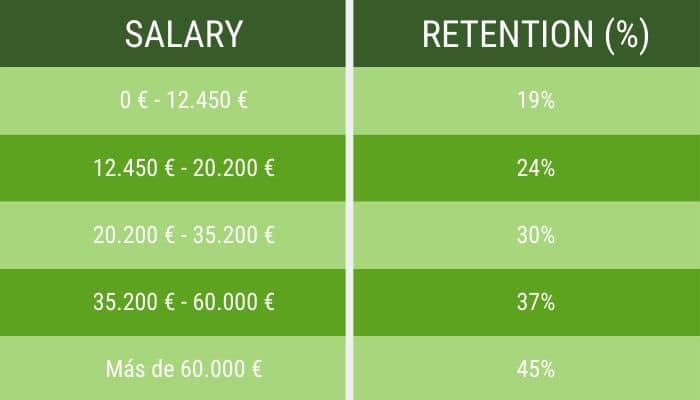

That will depend on the income you generate worldwide. This means that this tax is progressive, its percentage being increased the more you earn per year.

Basically, this income tax has two different components:

- General taxable base, which ranges between 9.5 and 22.5% in Spain, and then according to your region an extra must be added (in Catalonia, for example, it goes from 12.5 to 25%).

- Savings tax base, going from 19 to 23% (which are capital gains and part of the interest, something we will explore later on).

Contrary to the case of non-residents, in this case, you can have deductions and personal allowances.

As we are talking about particular cases and there is no general advice, we suggest you contact our tax lawyers so we can provide personalized assistance by helping you optimize your taxes.

As a foreigner worker, you will need to contribute to the Spanish social security system, unless you receive a certificate of coverage from your home country.

And this leads us to understand how that income tax is actually paid.

If you are working for a company, you receive a salary every single month. That salary is made up of a gross and a net amount (the net amount being the one you actually get on your bank account).

What is the difference?

Out of your gross salary, the company that has hired you pays monthly contributions to the Social Security and income tax on your behalf. In that way, usually, when you file your income tax declaration in June you don’t need to pay extra, as the company has been deducting it for you throughout the year.

But what happens if you are a self-employed individual? In general, you will pay at minimum €294 for Social Security every single month (even though you can decide to pay more in order to have a better pension in the future).

If it is your first time registering as self-employed, you can benefit from a flat rate of €80 per month for this first year.

You can learn more about self-employed or autónomo taxes here.

A big difference stemming from tax non-residency and residency arises here, because social security contributions are deductible for residents but not for non-residents.

A special income tax regime for expats that will save you money

Do you dislike the progressive tax rates that we have in Spain? Well, then you will really enjoy the application of the Beckham Law.

How can you benefit from this law?

If you are an expatriate who starts living in Spain, you will be able to save money with the Beckham Law, as it will allow you to pay just a flat rate of 25% on your incomes, never paying higher than that.

This means that you will be considered as a non-resident for tax purposes.

Which are the conditions that you need to fulfill in order to be eligible for this rule? The most important thing is that you must not have resided in Spain during the 5 years prior to the application process for this tax exemption. Furthermore, you will need to have a job contract, and the work must be performed in the Spanish territory (although there are certain flexibilities).

Avoid paying twice: double treaty conventions

Let’s say that you are a tax resident in Spain, but you obtain income from abroad too, for example in the US.

Of course, you will pay taxes in the US as you are generating that income there, but as we said, being a tax resident in Spain implies paying taxes for your worldwide income, so would you end up paying income tax twice for the same amount generated?

Luckily, the answer is no, thanks to what’s called double treaty conventions.

Non-resident tax

If you are not a fiscal resident but have a property in Spain or any other kind of asset that generates incomes, then you will have to pay non-resident tax.

Thanks to double treaty conventions, this non-resident tax will be just applied to properties and companies in which you are a shareholder.

This tax will be 24% on the income if you are a non-EU citizen, and 19% if you are from the European Union.

Let’s suppose, for example, that you live in the UK but have a property in Spain, and you rent it out throughout the year.

Then you will just be taxed by all the incomes that you generate via that rental, and the bad news is that you cannot deduct any expenses in this scenario.

And what happens if you are not renting it, and have the property empty until summer when you visit the country? Unfortunately, you will have to pay the same tax taking into account the amount you would have paid if you were renting.

That is, 24 or 19% (depending on your country of origin) applied to 1,1% or 2% (depending on when the value was computed) of the cadastral value of the property.

Spanish wealth tax

Do you own a property in the country or any other asset Then you will need to pay the wealth tax in Spain, no matter if you are considered a tax resident or not.

And we are not just talking about properties or assets in Spain, the wealth tax applies for assets worldwide if you a resident taxpayer.

But don’t get scared: this tax is only applicable to highly valued assets. This means you have a personal allowance of €700,000 (€500,000 in Catalonia). Assets like properties, cars, boats, investments and savings, pieces of arts,… those are the kind of assets that will get taxed here.

Besides, if we are talking about your own property, you have an extra allowance of €300,000.

Bottomline: if you have assets that are worth over €700,000, you must pay wealth tax.

If you possess assets of a lower value than that, you will not have to worry about the Spanish wealth tax.

But let’s suppose you do.

For example, it is the case that you own a property valued at 1,5M€. How much should you pay then? The wealth tax ranges from 0,2% to 2,5%. But that percentage will only be applied to the value of the property that exceeds the corresponding allowance. Again, we are in front of a progressive tax: the higher the value of your assets, the higher the tax rate will be.

You must take these percentages just as a general rule because depending on the region you are living they can be higher. Furthermore, some Autonomous Communities present higher allowances. That is the case of Madrid, in which the allowance is equal to 100%, so there is no need to pay this tax.

How to reduce your wealth tax payment

There are two main ways in which you can reduce the total amount of money you should pay in terms of the Spanish wealth tax.

First of all, even though they are not many, certain assets can be excluded from this tax.

Secondly, by restructuring your investments, you can reduce the applicable percentage.

If you would like to exactly determine how to reduce the total amount you pay thus saving money, do not hesitate to contact us, as this may be a really specific issue we should cover carefully.

Inheritance tax in Spain

If you are from the UK you will probably know this tax by the name Inheritance tax. When should you pay this tax?

This tax is paid by the individual that accepts any given asset (the beneficiary) conceded as an inheritance.

Applying the basic theory to the taxes that an expat must pay while living in Spain, we should consider two situations in which this tax will be due.

First of all, if the asset is in Spain, regardless of where does the beneficiary lives, she or he will need to pay the Spanish succession tax. Furthermore, the contrary situation also holds; in which if the beneficiary is living in Spain, regardless of where the asset is held, the inheritance tax will also be paid.

The exact amount will depend, again, on the region and municipality in which you are based. This means that you won’t pay the same in Catalonia in Andalucia.

Capital gains tax

And what happens if you sell a property or shares of a company and you make money out of it? Well, again, taxes.

If you are a resident in Spain, you will need to pay between 19 to 23% in terms of taxes applied to the benefit obtained from the sale (of the property or shares).

Can you deduct anything from the price? Well, if you are a resident, yes you can: there are several bonifications to be deducted here, and to situations in which you won’t even pay it. Learn here the main exemptions on the capital gains tax.

Bad news if you are not because non-residents can just deduct the expenses from the lawyer, the notary, and the agency. Furthermore, non-residents outside Europe will pay a flat rate of 24%, a number that can be reduced to 19% if you live in any other European Union country.

Property tax & taxes when buying a property

There are three different taxes you will pay in case you buy a property in Spain, depending on your situation:

- Property transfer tax, a progressive tax that applies to second-hand properties. It ranges from 8 to 10% of the agreed price of the property

- For those buying a house from a developer: VAT (which will usually be 10%), and the stamp duty (1,5% in Barcelona)

VAT (Value Added Tax) or Sales tax

Finally, there is this tax that usually levies consumption, which is called VAT or “IVA” in Spanish.

It is the same tax you will already find applied in any product you purchase at a grocery store, or the extra you pay when hiring a freelancer or service provider to do a job for you.

The standard VAT rate is 21%, even though there is also the reduced 10%, the super-reduced 4%, and there are some products that don’t apply VAT (0%), like education courses.

You can find out all the information about the VAT tax here.

Spanish tax rates

As we have mentioned before, from April to May every single year you will have to declare and pay your taxes through your income tax declaration.

This declaration will include both your general and your savings incomes, which are taxed differently (there is the income tax part of the equation, then the capital gains one).

If we combine both, which are the exact rates you must pay according to how much you generate?

Here you can find the general brackets:

But be careful.

This would correspond to the generic case, and it does not mean that you will end up paying exactly the same as you can see in this table.

Why?

- First of all, because the percentage may vary according to the region in which you are living. Catalonia has different income tax rates than Madrid.

- The percentage that is applicable to you is computed differently depending on many personal factors, such as your age, whether you are married or not, if you have children, etc.

- There may be several allowances or deductions that you can apply, and those will reduce the percentage too.

Therefore, use this table as a guide, but bear in mind that in the end each case is different and you cannot rely on generics, especially with something as complicated as taxes.

Our recommendation? Contact us, explain your situation, and let us compute the exact percentage you must actually pay (plus some strategies to reduce it).

Personal allowances

If you are a Spanish tax resident, you can benefit from different allowances that will really reduce the total amount to be paid.

Which are those allowances:

- Money you donate any money to an NGO that is recognized by the government

- Pension plans and contributions, up to €2,000 per year

- Rental or mortgage payments as long as the contract is from 2014 or before

- Personal allowance of €5,500 for people under 65 of €5,550, €6,700 if you are 65 to 75 years old, and €8,100 for those over 75

- Extra allowances depending on your region. For example, in Catalonia there are allowances during the first year your children was born, if you become a widow/widower, etc.

Taxes in Spain for expats calculator

Would you like to know, according to your situation, which is the exact tax percentage you will need to pay in the country?

Then our tax calculator is for you! How to use it? Really simple: Send us an email at [email protected] detailing the following information:

- If you are a tax resident or not (if you are not sure, just explain your current situation)

- Which is the income level you obtain in Spain

- Which is your exact economic activity

- If you have a property or you are planning to sell one

And we will help you find out the best way to optimize and structure your taxes.

Tax optimization strategies

Now you already know which are the different taxes paid in Spain by expats.

As you can see, there are several differences depending on you being a tax resident or not, and many ways to optimize the total amount paid.

That is why we highly advise you to rely on the help of expert tax lawyers, like the one our team provides. Not only will it help you time and money, but also understand all your obligations and make sure you don’t miss any deadline (which could cost important penalties).

We can help you with your accounting and tax planning issues, and we are ready to help!

Book a consultation with one of our lawyers and solve all your doubts:

At Balcells Group we have been foreigners effortlessly moving to Spain for over 11 years. We help expats from all around the world with their immigration, business, tax and legal needs; ensuring a legally safe and enjoyable transition to the Spanish territory. Our multilingual team understands the importance of adapting to the cultural and legal specificities of our international clients. We offer a comprehensive service that combines the expertise of several generations of lawyers with the innovation needed to address today’s legal challenges, always striving to simplify processes and ensure reliable, effective results.

What are the specific tax rates and income amounts for the wealth tax in Cataluna? I only see the range here.

Hi Robert!

In Cataluña the rate ranges from 0ñ21% to 2.75%. As there are many deductions and bonifications, we would really recommend you to contact us at [email protected] so we can analyze your case carefully and help you optimize your taxes.

Thanks for reaching out to us!

I would like to move to Spain to my daughter, I am retired and a us citizen, I have social security and pension, do I have to pay tax in the us and Spain? I get retirement from Germany too. I was German and change to be us citizen. Do I have to pay tax in Spain and in the us?

Hi Sonja!

As taxes are a really specific issue and depend immensely on the specific case (in your situation, we would need to see if there are double-treaty conventions applicable), we cannot give you a straight forward answer. It would be required for us to analyze your situation carefully in order to exactly define which taxes and by which percentage you should pay in Spain.

In that sense, contact us at [email protected] at any time to give it a further look.

Thanks a lot for reaching out to us,

Kind regards.

I’m a tax resident in Spain i don’t work here but my wife does , she’s spainish I’m English I have a private uk pension and would like to take it as a lump sum I know I’ve got to pay tax on it but is the rate fixed or is it progressive thank you

Hi John,

The income tax in Spain is a progressive tax (the more you earn the higher the percentage).

Hope we have answered your doubt,

Kind regards 🙂

I am a retiree with dual citizenship holder from US/SPAIN living with SS/Pension, do I pay my taxes here in the US or there?

Hi Saul,

That depends on whether you are a resident in Spain or a non-resident!

Hello, if I am a UK citizen and live in Spain but am working remotely for a US company, do I need to make social security contributions or can I pay for a private medical insurance policy instead?

Hi Debbie,

Paying for a private health insurance will be fine in your case.

Hope we have solved your doubts! 🙂

Do I have Capital Gains Tax obligations here in Spain for the sale of my former home in the UK and if so how is it calculated?

Thanks

Hi Bernard!

Usually, Spanish tax residents do not have to pay capital gains tax for the incomes they obtain worldwide. Nevertheless, if you are a non-resident, you should only pay for the property if it was in Spain, but that does not apply to your case.

> Usually, Spanish tax residents do not have to pay capital gains tax for the incomes they obtain worldwide.

This contradicts “as a Spanish resident you need to pay taxes on the worldwide income.”

So which one is it? Or is capital gains tax from selling property abroad not considered a part of “worldwide income”?

Also, what is up with this Spanish “Deemed Rental Income” tax?

Do you need to pay this tax in Spain in case you have a second home abroad but you are a tax resident in Spain?

Thanks!

Hi Andy,

Spanish residents DO need to pay capital gains tax on incomes received worldwide. That is why if you have a second home abroad and receive income from that, you need to pay capital gains tax.

Hope we have answered your doubts,

Kind regards.

Became resident in February 2019

Looking for employment as not retired and living off savings . What tax do I need to pay

Also sold my home in uk last September 2018 does that come into any tax

Hi Michelle!

As a resident you need to pay taxes on the worldwide income you generate, in this case, your home in the UK.

Nevertheless, we are talking about a progressive tax in which you can also apply bonifications, therefore if you would like to know the exact amount you will end up paying we would really appreciate if you could send us an email at [email protected].

Kind regards!

We have moved to Andalucia and are about to go for Residencia. We have income to reach the required amount coming into a Spanish account. I do however have £45,000 in a UK account. As a tax resident in Spain and not the UK what taxation on the cash lump will i pay to Spain

Hi Paul!

You won’t pay any taxes on the money you have on your account.

Hope we have answered your question, for any other doubt do not hesitate to contact us!

My daughter is domiciled in Spain.

When she inherits my house in England approx £500.000 will she be taxed in Spain

Hi Chris!

That will depend on the value of the property. Furthermore, many political parties in Spain proposed to eradicate the inheritance tax in the country. That is why the situation may change in the upcoming future and maybe she won’t need to pay any tax. That is why we would really recommend you to send us an email at [email protected] so our tax lawyers can help you out and define what would be the best way to act.

Hope we have answered your doubts, kind regards.

if you’re a non resident and fall under the beckham tax do you still have to pay social security tax?

Hi Matthew!

Yes. The Beckham law implies a tax reduction that applies to taxes such as capital gains or non-resident income tax, never implying a suppression of tax payment.

For any other doubt do not hesitate to contact us at [email protected]

Hi

I am planning to retire (early) to Spain and will spend more than 183 days there a year. I will not work but will live off my savings (savings are in exchange traded funds (each year I will sell 4% of my portfolio to fund my living expenses)). Will I have to pay any taxes in Spain as I don’t have “income” but am merely spending my savings? (How about capital gains tax on the (hopefully) rise in value of the exchange traded funds? What if those gains are made into an account outside of Spain and I just transfer into Spain the amount I need to live each month?)

Thanks

Hi Andrew,

If you will spend more than 183 days per year in the country, becoming then a tax resident in Spain, yes, you should pay taxes on that!

For any other doubt do not hesitate to send us an email at [email protected], we will be glad to help you out!

We moved to Spain in Feb 2018. I got my residencia in May and my husband (Australian) got his in Nov 2018. We are both on the Aged Pension from Australia which is tax free as we are under the threshold. It’s less than €12000 each. Will we have to pay tax on pension income?

Does a home owned outside of Spain (United States) get factored into the yearly wealth tax requirement if I become a resident of Spain? I will continue being a tax resident in the U.S.A., so would be filing my taxes in the U.S.A. and Spain. Would the home still be considered a personal residence if it was rented out out while I lived in Spain? I am hoping that the home would qualify for the deduction of 300,000 Euros pertaining to the wealth tax allowance. I plan on renting a flat while living in Andalucía, Spain, and not purchasing property in Spain I think.

Also, for American retirement accounts such as 401K’s and IRA’s,when the fund manager sells and trades mutual funds but I do not take a distribution, must I pay taxes on the fund manager’s sell/trades when profit is made?

Thank you.

Hi Dana,

We have contacted you via email in order to provide further details, as your situation is really concrete and we need to know more information in order to correctly answer.

Thanks for reaching out to us!

Hi,

We are moving to Andalusia from within the EU on 01 August. I am assuming that even though I apply for NIE, residencia etc, I will not be automatically ‘tax resident’until 01 February 2020, and thus will file my first tax in Apr/May 2021 retrospectively for the tax year 2020? I have chosen 01 Aug to avoid CGT on property sale and so not resident for 183 days in 2019. Am I thinking right! Thanks.

Hi John,

Yes, you only become tax resident after 183 days per natural year lived in Spain; which means that you start counting no matter the month.

For any other doubt do not hesitate to contact us at [email protected],

Thanks for reaching out to us!

Hi Feb 2019 I have residencia

Jan 2019 I sold house in UK

I used majority of the profit to buy house in Spain it means I have one home and that’s in Spain.

Do I have to pay CGT on the rest? As in effect I will have paid the standard capital gains tax in the U.K. which was zero

Thanks

Hi Paul,

We would need to study your situation in more detail in order to give you an exact answer. Would you mind sending us an email at [email protected] so a specialized tax lawyer can get in touch with you as soon as possible?

Thanks!

If I live 5 months in Spain, 5 months in Dubai and 2 months in Ireland ( I am an Irish national) then Will I be liable to any tax?

Hi Julie!

In order to give you the exact answer (which taxes you would be liable and by which amount), it will be required that we analyze more carefully your situation. That is why we would really appreciate if you could send us an email at [email protected] explaining with more depth your situation so our tax lawyers can assess it.

looking forward to your email!

1) Regarding the wealth tax, you did not say whether it is annual tax or one-time tax ?

2) Spain by these taxes is the hill of taxes !

Hi Ana!

The wealth tax must be paid once per year, every single year (unfortunately). And yes, the Spanish tax system can be a bit complex due to the high amount of taxes to be paid. But that is why we are here, to make your life easier in that sense optimizing your taxes 🙂

Hello, like many I am confused over the tax situation here in Spain and would like to ask some advice please. Our circumstances are that we, my wife and I, have retired early on a limited income, we have savings in a UK bank account and use this to top up my private pension which I have activated as I have to wait 6 years until I get the UK state pension, and my wife another 10 years!

If we purchased a property in Spain, say for 130,000 and our income was say 20,000 per year, made up of pension and savings, would we have to pay income tax?

Hi Jeff!

As your situation is really concrete, we would need to analyze it carefully and with more depth, as we cannot give you a straight-forward answer here. For that, we would really appreciate if you could send us an email at [email protected] so our taw lawyers can get in touch with you as soon as possible.

Thanks a lot for reaching out to us,

Looking forward to your email.

Hello,

I live in Canary Islands with full residencia and pay tax and social security. My daughter recently came into some money and wants to give me about £40,ooo .I have a bank account in England ,with not much in it.If she pays this money into the account will it be liable for Spanish taxation or is it better to declare it for Impuesto Sobre Sucesiones y Donaciones as I am a bit confused as to how much can be in a U.K.bank account before being taxed by Spain.

Thank You.

Hi Roger,

As this situation is really specific, our tax lawyer would need to analyze it with more depth, as it is really complicated to give you an answer with this information. That is why we would really appreciate if you could send us an email at [email protected] so we can try to exactly define your situation and then tell you what would be the best way for you and your daughter to proceed.

Looking forward to your email,

Kind regards.

Hi, since i am planning to retire in Spain and the wealth tax is a major issue i concerned. and i understand that for those assets that i acquired before my immigration, they are not counted for the wealth tax calculation, am i right?

thanks for your advise.

Hi Alan,

Yes, you are right!

Hi,

I am on this Special Tax Regime for highly skilled expats and I wonder if I am eligible for using the Tickets Guarderia to pay for my kid´s daycare. HR and Accountancy of my employer give contradictory information. Thanks

Hi Anna-Maria!

As that is a really specific situation, we would need to analyze it carefully. That is why we would really appreciate if you could contact us at [email protected] providing additional information so we can answer your question.

Thanks!

Hi anna-Maria, same here, what happend in the end?

Hi we have rental income in our country and also have my own private residence. We are planning to be residents in Spain and open a small business in the tourist industry. Am I still entitled to pay wealth tax (patrmonio).

Hi Lorraine,

If you become resident and furthermore open a small industry, depending on the net value of the assets you will be entitled to pay, yes. Nevertheless, do not hesitate to contact us at [email protected] in order to precisely define the exact percentage and if there is any bonification in your concrete situation.

Thanks for reaching out to us!

I live in the USA and would like to move to Barcelona, Spain this year. Looking to start a small business for tourism and perhaps another small local business to earn a little extra income. What is the tax rate I would need to pay?

Hi Jerry!

In order to answer your question, we would need a bit more information. Because defining the tax rate will depend on the type of activity, if you will be a resident or not in the country, if you will have a property…

Hi, will my UN pension be taxed in Spain? I understand that I have to declare all of my income on my resident tax return. Do I declare my UN pension for calculation purposes only, or will it be taxed? Thank you.

Hi Tracy,

That is a really special regime, therefore the UN should give you indications regarding how to proceed, even though this type of retributions from International Organizations use to be exempt from paying taxes.

For any other doubt, we are here to help!

This is something I have been trying to find a tax consultant on as well, the legal ruling was….

Superior Court of Justice of Catalonia, decision number 326 /2007, dated March 28 2007 Superior Court of Justice of Catalonia, decision number 326 /2007, dated March 28 2007 (See Schwarz on Tax Treaties 3rd Edition (CCH) Chapter 2 para 10-175 on the exemption for UN employees)

But I have also not been able to locate anyone who has used it. Can Balcells?

Unfortunately, we haven’t had the experience of this. However, we can have a consultation to know your situation and see how we could help you. After that, we could study the specific regulation that could apply and let you know the next steps in order to help.

Email us at [email protected] if you would like to talk to one of our tax lawyers.

Regards! 🙂

Hello,

Are Military Pensions (my husband is retired US Air Force), taxable in Spain? My understanding is that US Social Security benefits are taxable but I cannot find anything that addresses US Military Pensions.

Thank you!

Hi Jennifer,

Yes, military pensions are also taxable!

Kind regards.

Hello,

I benefit from Beckhm Law and currently working. So for tax declaration I fill Modelo 151.

Last year I bought a house in Spain which we are living in currently and paid all relevant taxes like a normal Spanish tax resident, including Hipoteca taxes.

Is there any possibility that I can declare and get back any of the taxes I paid during the buying process?

Modelo 151 does not seem to have any part to declare buying a house.

thanks!

regards

Ali

Hi Ali,

In that case, the taxes that go hand in hand with the purchase of the house are indistinct to the Beckham Law Annual Tax Return, therefore there is no possible way to deduct expenses under the Beckham Regime.

If there is anything else we can do for you, do not hesitate to contact us at [email protected]

Kind regards!

Hi, my husband and I are now taxpayers in Spain. We have a UK endowment policy which has matured and which, in England, is tax free. Is this also exempt in Spain or do we have to pay tax on this income?

Hi Sarah,

We would need to study the endowment policy in order to determine whether if it is tax-free or not.

Hello,

I have a job offer from Spain(I currently work in another EU country), in IT industry, that being 30.000E Gross Per Year, in Madrid.

I want to know If it is enough, how mouch on NET it will remain to me monthly? That would help me a lot to know if I can do it well in this country.

Thank you so much in advance,

Marcel

Hi Marcel,

We cannot give you a straightforward answer, because when it comes to the income tax (IRPF), each situation is different. It will depend on your contract, the region you are living in, if you will be a resident or not… That is why we would appreciate if you could contact us at [email protected] so we can analyze the situation much more in-depth.

Thanks for reaching out!

Well, basically, I live in Romania, they offered 30.000 Gross/Year,undetermined contract, for Center of Madrid city. An estimation maybe? will it be 2000 at least in hand(NET)monthly? That’s all I would want to know basically..

Hi Marcel,

We cannot give you a straightforward answer, the income tax depends on different factors and we would need to analyze further. It is probable that yes, you will have 2.000 per month. But it is just a guidance.

Kind regards!

I have a crown pension in the uk (police)

I own a property in Spain and in the uk jointly with my wife total value of £500000

Neither property is rented out when I’m not using it

I work earning a few thousand pounds in the uk per year

I spend about 8 months per year in Spain (Tenerife)

Can I be resident in Spain and remain fiscally resident in the uk

Yes, but only if you can be able to obtain Residency Certificates from the UK Tax Agency, covering the natural years you want to remain as Non-Resident for Tax purposes in Spain.

Hello, Me and My wife lived in 2018 from 1-1-until 29-9 in Spain, that is more than 183 days. Do I have to pay the full year 2018 or only the first 9 month’s.?

Hi Peter,

As you are a tax resident, you need to pay for the full year.

Kind regards!

My husband and I are American citizens,over 65 years old, both retired in the United States,and living solely on Social Security retirement benefits, not exceeding $31,000 a year. We’re planning on moving to Spain and renting a flat there. (My husband is also a Spanish citizen living outside of Spain). Do we need to pay taxes in Spain on our U.S. Social Security retirement income?

Hi Maritza,

That will depend on the type of pension. If we are talking about a public pension, they are usually tax-exempt in Spain. If the pension is private, you may need to pay taxes in Spain for the incomes it generates, it will depend on the exact conditions of the contract.

If you need us to precisely answer your question, please send us an email at [email protected] attaching the documents you have so we can check it specifically.

Kind regards!

If one moves to Spain (from US) for retirement and becomes a tax resident (>183 days in country pre year), are disbursements from US retirement accounts (Roth IRA AND non-Roth (401K) type) taxed as income on the sliding scale percentage?

Hi Kirt,

It depends on the type of retirement policy. We would need to study the document in order to give you an exact answer.

Kind regards!

Are US assets (savings and retirement accounts) considered when figuring Spain’s wealth tax? Or is this only on Spain assets?

Hi Kirt,

That will depend on your status: if you are a tax resident in Spain, worldwide assets will be considered (including US ones), and if you are a non-resident, just the ones in Spain.

Hi!

Is there a certain amount you have to earn when it comes to the beckham law?

Kind regards,

Isabelle

Hi Isabelle!

No, there is not a minimum. But bear in mind that, if the tax rate that is currently applied to you without using the Beckham Law is lower than 24% due to the exact amount of income you receive, then it won’t be a useful option to go for it.

Hi I have a property in Spain but have never stayed here for more then 183 days. I used a solicitor to purchase this but he never told me about property tax. I have just found out I need to pay this and fully accept a need to submit a form 210. My question is will this tax be calculated form the purchase date or when I first used the property. I pay all local taxes and utilities

Hi Mary,

Property taxes, in this case, will be computed since the purchasing day.

Have a nice day!

Hi, I am British and a spanish resident, non tax paying as I live off my medical pension which is non taxable. My boyfriend is french and works in France but has moved in with me in Spain. He cannot find the right information about his taxes. He is a government worker in France, where should he be paying his taxes?

Hi!

That will depend on the incomes/assets he has and if he is a resident in Spain or not. If you would like us to analyze the situation and give you a specific answer with all the taxes, please send us an email at [email protected] detailing his current situation and we will help you out!

Kind regards 🙂

Hola

I am a UK state pensioner (68 years) and becoming resident in Spain – I own a house here. I would like to continue working as a consultant for my company in the UK for a few thousand £/€a year extra, and perhaps also do some work in Spain. In general terms – how can I best do all this legally? And if I sell my company in the UK, will I have to pay tax in Spain once I am resident? In the UK I would get a reduction fin tax due to Entrepreneur allowance. Thanks.

Hi James,

As your situation is really specific, we would like to ask you some additional questions in order to better understand your case and which would be the best way to proceed. For that, would you mind sending us an email at [email protected] so a business and tax lawyer can get in touch with you as soon as possible?

Thanks a lot!

Hi, we are Canadian Citizens and my husband gets a Union pension and I get a an old age security pension and a small pension from CPP, (Canada Pension Plan) My husband is not old enough to get an old age pension. I also get a small old age pension from the UK. If we moved to Spain we will have to pay a non-resident tax of 25% of our pensions to the Canadian Government and these are non refundable, which means we cannot claim anything back at the end of the tax year. I am not sure if I would have to pay tax in the UK on my £289 a month UK pension?? Would we have to also pay taxes in Spain as this would be our only income. We would not be working in Spain, so no income from that Country.

Hi Mary,

As your situation is really specific we would really appreciate if you can contact us so we can ask you for the information we need in order to give you a clear and complete answer.

Thanks a lot!

HI worked in Spain until October 2011 for a period of just over 2 year when I had a secondment contract (I was still paying national security in France). Am I eligible to benefit from the Beckham if I would to return to Spain for work?

Hi,

One of the main requirements of the Beckham Law is that you can’t have lived in Spain before, therefore if you were working here, you cannot benefit from it.

Hello. We are an English couple with a property we’d like to rent out in Galicia.

If we do, how do we go about paying the income tax (19%) as we do not have an NIE, are residents less than 180 days per year.

We do not want to fall foul of the system.

Thank you for your advice.

Hi Michelle,

You should already have an NIE as you bought a property in Spain. You should check in the Deed of Purchase because, in order to purchase any property, you are required to have one, even if it is just a temporal one.

Hi we are Spanish fiscal Residents in Spain and have been paying our Spanish taxes we only have our UK state pension. My question is as we sold our property but are now renting in Spain and no longer own a property in spain do we still have to pay taxes?

Our ages are 67 and 78

Hi Margaret,

You should pay taxes on the worldwide income you receive and assets you have, as you are tx residents. The pension would not be taxable.

So if our pension is the only income we have coming in we don’t need to put in a tax declaration every year? is that right. We don’t get any Interest on our Bank Account.

Hi Margaret,

If it is a Public Pension, you wouldn’t have to pay tax on it, most probably. But we would need to analyze the situation precisely to give you a concrete answer. You can send us an email at [email protected] for that! 🙂

Hi I have just moved to live in Spain this year (Jan2019).

I have a house in the UK that I rent out. Will I have to pay rent on this in the UK or here in Spain?. I have become resident in Spain.

Bob

Hi Bob,

If you have become resident in Spain, you need to pay for your worldwide income in the Spanish territory.

Here for anything else you may need!

Hello! We read that Andalucia recently changed its tax policy, is that true please? If so, does that mean that expats who live there (but get their money from abroad) would no longer pay wealth tax and would pay a maximum of 25% tax on everything they win (worldwide, including capital gain or bank interests for example) instead of a progressive rate up to 45%? Many thanks for your time and your answer, Claire

Hi Claire,

We are based in Barcelona and therefore not really updated about the Tax rules in Andalucia. We advise you to contact tax advisors based in that region in order to get the answer that you need.

Hope you understand!

Hi even after researching the tax situation I am still unclear on whether I am liable for Spanish Income Tax.

I am British, I live in Spain however I spend less than 183 days in Spain in the Tax year, I work outside the EU on assignments for a non-Spanish company & am paid in US$, I have obtained my NIE & are applying for residency (1st 5 years). Am I required to pay Spanish Tax.

kind Regards

Hi Bruce,

There is no necessity for paying taxes in Spain, as long as you don’t get income from a Spanish employer or have any assets in Spain, and always that you don’t stay in Spain for more than 183 days in the natural year.

For anything else you may need, we are here to help!

Hi.

I’m researching the tax situation and still unclear to me if i should pay income tax in Spain or not.

The situation is as follows: me, my wife and child live in Spain, we are not Spanish, but from another EU country. I work only outside of EU for non-Spanish employers, and i spend less than 183 days/year in Spain, but my wife and child do spend more than 183 days/year in Spain. Our only source of income is my salary, which i’m getting abroad. Now we are renting a house, but we plan to buy one in the near future.

So, in this case, i’m considered a Spanish resident for tax purposes and have to pay progressive rate tax?

Thank you.

Yes, you are considered a tax resident, because the center of personal interest is in Spain. Most probably the Tax Agency would consider the whole family Tax residents here.

Hi Balcells friends, I’m non-resident in Spain and I own a property that I rent. My property manager files my rental income tax, so no problems. However, I’ve also invested in mutual funds via my Spanish bank. If i sell with profit, do I hove to report gain? when and how? Isn’t mutual funds exempted?

You would have to declare them, possibly paying taxes when the economic gain takes place. As we are talking about a really specific type of declaration, we would need to talk to you in person, so please send us an email at [email protected] for more details!

Thanks a lot.

Hi,

I’ll be working for a company based in the USA and I’ll be paying IRPF in Spain as well. My questions are: 1) do I need to ask for a certificate of coverage from the USA company (I’m in my 30s)? 2) do I need to pay US state tax on my income as well?

Thank you!

Hi Amaya,

In regards to the first question, we are not completely sure what you are referring to. And, in regards to paying US state tax, you should check with an accountant there as it will depend on the taxation rules from there.

Regards!

Hello,

I was reading your requirements for being a tax resident.

I will spend 170 days here this year, which includes the month of August when I returned to the US, my home country. I am a Spanish Citizen.

I don’t have a spouse in Spain.

The clause that worries me is ‘You have economic interests in the country, meaning that you realize your professional activity in Spain, whether you work for a company or you are self-employed’.

I have been just offered temporary work teaching ESL in Barcelona. Does this mean I will become a tax resident if I accept that work? I am mostly retired but do want to teach in Spain.

Hi Robert,

In this specific case, you could still be considered non-resident as long as the job in Spain is temporary and you spend less than 183 days in the country during each natural complete year.

hi i am 69 and want to go to Spain to live in February 2020 do i have to pay tax on my military pension and my state pension both total £1480-00

Hi Robert,

They would both be tax-exempt in Spain provided that we are talking about public pensions and as long as you already paid the corresponding tax on the UK for them.

Hi

I work in UK on. 3/3 rota earning around £60k per annum, I would like to move to Spain. Will I be able to avoid UK tax And will there be any change after Brexit. I will effectively be living a bit less than 6 months in Spain?

Hi Richard,

Nobody knows the consequences of Brexit, but living in Spain less than 6 months per year, probably you wouldn’t be considered Tax resident in Spain. About UK Tax, an advisor/tax accountant from the UK should be able to give the answer on whether you would have to pay tax there or not.

Hello, my situation is the following: I moved to Spain with my wife at the end of August, I got my NIE and we are still waiting for the documents for my wife (she’s not an EU citizen so things happen slower). I am not working in Spain. By the end of the year I will have spent less than 183 days and I do not have Spanish income. Am I considered a tax resident in Spain for 2019?

Hi Ivan,

No, you will be considered a non-resident.

Kind regards!

Thank you for the quick answer! So the fact that my wife is here with me doesn’t matter in this case? Also the NIE registration doesn’t affect the tax resident status, correct?

The resident status depends on the number of days you spend per year in Spain.

For any other doubt do not hesitate to contact us at [email protected]! 🙂

If I move to Spain and deposit €500,000 in the bank. Do I pay taxes on the deposit or only on the interest I get from this deposit

The interests and, most probably, wealth Tax. A deep study of the situation would require a consultation with our specialist, at a cost of 50€+VAT.

Hi, i am about to move in Spain for at least a year. I have a company in my EU country, and paying taxes there. I will live more than 183 days in Spain, and working remote from here. I am in Amazon business, selling goods in USA, and Amazon will pay me in my account based in my EU country. Should I pay any taxes here, in spain? Thanks!

Hi Maria,

As there are some conventions between the US and Spain regarding taxes for citizens in the country, we would have to analyze your situation carefully. Send us an email at [email protected] and one of our tax lawyers will get in touch with you as soon as possible.

Thanks a lot! 🙂

Hola,

I am a UK citizen and I started a new work contract in Spain mid-May 2019. This is likely to run until end March 2020. I have a NIE and have just received my Special Taxation Regime certificate. I estimate that I will spend approximately 114-120 days in the UK between 6th April 2019 and 5th April 2020. I was employed in the UK from 6th April 2019 to 10th May 2019 and my UK PAYE was deducted as normal. Please would you able to advise if I will be liable for any UK income tax on my Spanish earnings for the 2019-20 tax year? My Spanish contract provides my only income now. FYI My income would place me into the 40% UK tax bracket.

Regards

We are not specialized in Tax in the UK. That would be to determine by Tax advisors there. For the Spanish side, under this Taxation Regime, you would only have to pay tax on the income generated in Spain and, in that sense, we could offer assistance at the time of filling the specific Tax Forms related, at a cost of 150€+VAT

I want to know how much tax I would have to pay on my UK state pension as my ONLY income as a Spanish resident I have lived and worked here and now on my state pension

Normally, according to this, you would pay tax on your State Pension in the UK. As Tax Resident in Spain, you would have to declare it, but no extra tax would apply, the general rule says.

Hello,

Have the following situation:

Cam from Romania in Madrid and started working on 29th of July.

Received the salary with 24% IRPF tax on July, August and September.

Currently I enrolled on the Spanish Tax Office filling the 147 form to become Spanish Fiscal Resident and with the certificate that I will receive It will be applied the normal IRPF tax (around 17%) on the next salaries.

My question is, is there any way I can recover the difference I lost on the months I paid 24 instead of 17?

Thank you,

Marcel

Hello Marcel!

There are two options here we can foresee: either you wait until the Tax Declaration of IRPF next year, between April and June, to do the balance and compensate, if applies; or you talk to HR in your company to see if they can modify the percentage in the next payslips in order to compensate that bigger retention you had.

Hope that helps!

I am very impressed with the quality of your answers. Thanks for the effort you are putting into this service!

The majority of my income comes from long-term certificates of deposit. The US taxes the interest earned each year, even if the accrued interest has not been paid. Spain taxes the interest only when certificates of deposit mature.

To give an example, imagine I am an American living in Spain. If my CDs outside of Spain earn $50,000 in interest each year over a five-year period, the US taxes me on the 50k each year. Spain would tax me on $250k in interest only in the final year. In this case, I would imagine I would deduct the amount I had paid over five years in US taxes from the lump sum owed Spain.

But what occurs if I become a Spanish resident only in the final year of those five years? Would Spain treat this the same way as above? Or would Spain only look at the interest earned in the final year vs. the taxes paid in that final year?

I ask because the timing of my move to Spain depends on the answer. Thanks again.

Hi Allan!

For that, we would really suggest you talk to one of our tax lawyers, as the answer is really specific and we would need to ask you several other questions in order to answer.

For that, feel free to email us at [email protected] 🙂

Hi

How do you go about paying late autonomo taxes in spain, and what are the penalties? If, for example, you earned 50,000 worldwide income in 2015, what would you need to do to register and pay it, and how much late penalties would there be?

Hi!

There’s a specific legal procedure you should initiate in your case. For that, we suggest you to have a consultation (we can do it online) with our accountant, so she can explain to you step by step how to proceed. You can schedule it by sending us an email at [email protected]

Kind regards!

Hi

I am a Tax Resident of Spain.

I am originally from Norway where I am deemed 100% disabled.

I have no disability degree here in Spain.

I earn about 32 000 euro yearly.

What should I pay in tax and do the Disability have anything to say?

How do I get the Norwegian disability degree to be accepted in Spain?

Hi Rune,

We would need to analyze your situation more carefully in order to give you an exact answer. For that, would you mind sending us an email at [email protected] with further details?

Thanks a lot!

We are a US-based couple, one US/EU dual national and the other a US citizen. We would like to make Spain a primary location to spend our years in retirement. In consideration of the wealth tax and income tax however, we’re trying to figure out if there’s any tax-friendly way to become a tax resident in Spain vs. a resident staying less than 183 days. For example, if someone had a traditional IRA worth 2 million or more, and other assets of roughly the same amount, then it appears to us that the annual wealth tax on worldwide assets, combined with very high income tax rate on required distributions from our IRA’s could be prohibitive. Our understanding is that staying under the 183-day threshold would not expose us as much to Spanish tax. Are there any efficient planning opportunities based on these basic facts?

Yes, we could explore some planning opportunities. But we would need you to send us all your information at [email protected] so one of our tax lawyers can get in touch with you directly and send you that information (as it can be too long to answer here). Thanks!

I am a budding entrepreneur and just studying taxation. Thanks for the informative blog. You helped me learn more

about taxes for exspats.